Nevstar Links 24 January 2025

Welcome back to the Nevstar Links! We hope you had a great Christmas and enjoyed the festive break. The Nevstar Links returns in 2025 with more must-read articles on markets, business, and investing.

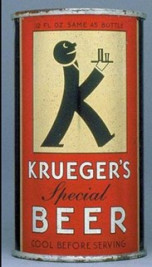

Today is Friday 24th January which just happens to herald the 90th anniversary of an extremely important historical event. It was on this day in 1935 that the Gottfried Krueger Brewing Company became the first company to offer canned beer! Canned goods were very important in the mass distribution of food in the late 19th century but it took until the 1930s for American Can to develop a can that was pressurized and had a special coating to prevent the fizzy beer from chemically reacting to the tin. The response was overwhelming and by the end of 1935, over 200 million cans had been produced and sold. The rest, as they say, is history.

Onto the Nevstar Links for the week:

Seven Lessons From 2024

First up we have this very readable blogpost from Charlie Biello looking at some lessons we can derive from market movements in 2024. Timely reminders of some of the most important lessons that we need to understand about investing.

"The stock market goes up over time, but not all the time. It's far from straight line higher and most years do not look like the 10% historical average. Returns are lumpy as we're seeing once again in 2024."

Three Improvements For 2025

Good piece from Rubin Miller CFA outlining three ideas that might help improve our lives as people and investors. Some good thoughts to start the year at this time of resolutions and goal setting.

"There is nothing wrong with being aware and present, but life isn't always pleasant. The mindfulness paradox is that when things are bleak, too much focus on the present state is suffocating. Start believing things will get better."

The Most Hated Stocks In The World

Excellent piece from the invaluable Ben Carlson debating the merits of international equities (from a US investor perspective) in the midst of an era where US equities have consistently outperformed other share markets for over a decade. Is it a case of 'this time it's different' or will 'reversion to mean' win out?

"Everything I've ever studied about market history tells me there is nothing more reliable than cycles. Strategies, geographies and factors come in and out of favour. Nothing works forever. But I can't rule out the possibility that technology has changed things."

See also: Mega Cap World Domination

There Are Idiots: Seven Pillars of Market Bubbles

Fantastic blogpost from Arcadian Asset Management which outlines the seven pillars to help understand speculative mania using the current bitcoin / crypto melt-up as an example. A must-read to help understand and avoid the inevitable next bubble.

"Bubbles often involve glorious visions of a utopian future of unlimited prosperity. Raskob is part of a long tradition of 'democratizing finance', which in practice sometimes means selling overpriced assets to suckers."

On Bubble Watch

The final link for the week is the latest quarterly memo from the essential Howard Marks of Oaktree Capital - arguably the finest investment writer in the world. His memos are always highly readable and contain fantastic insights into the history of markets leading to an enunciation of his current view. This time he explores the theme of bubbles again - 25 years after writing about the tech bubble of 2000. Print it out and take it away for some weekend reading.

"When you can't imagine any flaws in the argument and are terrified that your officemate / golf partner / brother-in-law / competitor will own the asset in question and you won't, it's hard to conclude there's a price at which you shouldn't buy."

Quote of the Week

"Judge a man by his questions rather than his answers."

Voltaire

That is all for the Nevstar Links this week. Please share this with anyone that you think might be interested in reading it. You can subscribe or unsubscribe by sending me an email at [email protected].

If you would like to conduct a review of your existing investment portfolio, or discuss investing generally, please feel free to give me a call at JMI Wealth on 09 308 1450.

Have a great weekend.

The Nevstar

To find out more please call the following investment advisor for a chat on +64 9 308 1450 (alternate contact below) or send us a message at Contact Us.

Neville Giles

+64 27 257 5711