Monthly View - April 2025

Liberation Day – April 2nd

This month’s market commentary covers developments in March and the first two weeks of April. Over the last four weeks financial market movements have been dominated by US President Trump’s trade policy announcements. Asset prices have been driven by policy and macro-economic concerns, corporate news has been pushed into the background.

Global financial markets spent March focused on what US President Donald Trump labelled “Liberation Day” for US trade policy, the 2nd of April when he had scheduled to announce like-for-like tariffs against a range of countries.

On the day, Trump announced reciprocal tariffs on countries around the world. This included imposing a 10% tariff on all imports and much higher rates for some nations e.g. 34% on China, 24% on Japan and 20% on the European Union. Trump also announced 25% tariffs on all foreign-made automobiles. Steel and aluminium are exempt from reciprocal tariffs but remain subject to the 25% tariff rate announced in March. The level of tariffs announced were larger than financial markets had expected.

New Zealand is relatively well positioned with exports to the US falling under the 10% reciprocal tariff regime. Although the direct impact of tariffs on New Zealand is expected to be small, second round impacts such as slower global economic growth and downward pressure on domestic inflation will need monitoring. These second-round impacts will be factors influencing future decision making by the Reserve Bank of New Zealand (RBNZ).

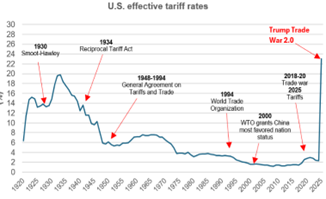

Based on tariffs announced on 2nd April, the US average effective tariff rate is 24.0%, levels not seen since the 1920s and up from 2.4% at the end of last year.

Source: The Real Economy Blog

Within a week of imposing the tariffs of the 2nd of April Trump temporarily reduced imposed reciprocal tariffs on non-retaliating countries to a flat 10% for 90 days to encourage negotiations, while sharply raising tariffs on Chinese imports to 125%. Industry specific tariffs remain, such as on automobiles.

Trump’s pause was a positive surprise for markets, with US equity markets experiencing their best day since 2020. However, markets are still down from their highs earlier in the year.

US trade policy developments over the last few weeks highlight the fluid nature of Trump’s trade negotiations and underscores the importance for investors to take a longer-term view.

Global Equities

Global trade [1] uncertainty will remain for some time. It is expected to take weeks of gruelling trade negotiations before actual tariff rates are known. Although it is likely that tariff rates for some countries will eventually settle lower than those imposed on Liberation Day, tariffs are here to stay for the time being and this is a new world order.

The economic impacts of tariffs depend on their level and duration. Based on what has been announced, economists have been adjusting their forecasts by reducing economic growth rates and pushing higher intermediate inflation outcomes (reflecting the base case scenario where tariffs result in a one-off impact on inflation).

Global sharemarkets fell -4.5% in March, led lower by the US (-5.6%). Following the larger than anticipated tariff announcements in early April, global equity markets fell sharply over the following days on worries of a global trade war and increased fears of US recession.

Australasian Equities

New Zealand’s sharemarket [2] fell -2.4% in March, largely taking its lead from offshore markets with little corporate news given the completion of the earnings season in February. The local market fell further in early April following Liberation Day. Although the market is down, it has fared better than other global markets given its more defensive nature and limited number of companies directly impacted by the US 10% tariff rate. Those companies caught by the tariff can undertake measures to mitigate the impact, such as diverting sales to other markets or passing on some of the price increases to US consumers. By way of example, although Fisher & Paykel Healthcare’s New Zealand production is subject to the 10% tariff for exports to the US, its Mexican production is currently exempt from US tariffs given US-Mexican trade arrangements.

The Australian sharemarket [3] declined -3.4% in March. It’s been hit harder by Trump’s tariff policy than New Zealand so far in April, reflecting more companies directly impacted by the imposition of tariffs and greater sensitivity to the second-round impacts of slower global growth, particularly with Australia’s close economic ties to China. Australian companies that have underperformed include those with high earnings to the US e.g. James Hardie and with earnings more sensitive to slower global economic growth e.g. Flight Centre. Gold stocks and health care companies such as Cochlear and CSL have outperformed.

Fixed income and cash markets

The Bloomberg Global Aggregate Bond Index (New Zealand dollar hedged) fell 0.5% in March. Although longer-term interest rates were flat to lower in the US, the rise of longer-term interest rates across Europe on the prospect of an increase in government spending led to losses from global bonds over the month.

During March there were increasing signs that US policy uncertainty was impacting on the US economy. Notably consumer confidence has fallen sharply. For example, the Conference Board measure of US consumer confidence fell to a four-year low. This survey also recorded a rise in inflation expectations. As highlighted in the graph below, US Small Business Confidence fell again in March.

Source: AMP Capital Australia

Following the tariff announcement, US Federal Reserve (Fed) chair Jerome Powell said the US economy was likely to face a period of higher prices and weaker growth because of larger-than-anticipated tariff hikes.

The Fed wants to ensure one-time price increases don’t lead to persistently higher inflation. The Fed is in no hurry to adjust interest rates and is well positioned to wait for greater clarity. In March, the Fed left the Fed Funds Rate unchanged in a target range of 4.25% to 4.50%, for the second consecutive meeting.

New Zealand’s fixed income market [4] returned 0.2% in March, reflecting little movement in interest rates over the month. The Reserve Bank of New Zealand cut the Official Cash Rate (OCR) to 3.50% in early April. The OCR is expected to be near 3.0% by the end of the year.

Global fixed income markets have also witnessed increased levels of volatility over the early part of April. After initially declining on economic growth fears, US longer-term interest rates rose sharply given the policy uncertainty leading to a loss of confidence in US Treasuries and US dollars as safe haven assets, rumours of China and other countries selling US bonds and hedge funds unwinding highly leveraged positions.

The volatility in global fixed income markets is likely to fade as investors return their focus on the negative economic growth impacts of tariffs. In such a scenario, longer-term interest rates will drift lower and fixed income can play its traditional role as a portfolio diversifier.

Conclusion

The uncertainty from Trump’s trade and tariff policy is likely to continue for some time, which will be unsettling for markets. There will be a period of back-and-forth negotiations as trading partners seek to reduce the level of tariffs and engage in specific concessions for different industries.

Along with ongoing tariff negotiations, which may bring further positive surprises for markets, other developments may also bring relief for global equity markets. These include central banks continuing to reduce interest rates, particularly in Europe, Australia, and New Zealand, the prospect of political pushback in the US resulting in a toning down of trade policy, and a pivot by the Trump administration to promote the more positive elements of their policy agenda such as tax cuts and deregulation.

Given recent development it is clear that the Trump administration has a pain threshold and that share and bond markets are also able to impose some constraints around polices as well.

The developments of recent weeks are unwelcome though market pullbacks of the nature experienced do occur from time to time.

At times of market volatility, we encourage investors to continue to focus on their longer-term goals, look through the short-term volatility, and maintain a portfolio commensurate with their objective and risk profile.

1 MSCI ACWI Index in local currencies

2 S&P NZX 50 gross index

3 S&P ASX 200 total return Index

4 Bloomberg NZ Bond Composite 0+ Yr Index

Indices for Key Markets

| As at 31 March 2025 | 1 Month | 3 Months | 6 Months | 1 Year | 3 Years p.a. | 5 Years p.a. |

| S&P/NZX 50 Index | -2.4% | -6.2% | -0.9% | 2.1% | 1.3% | 5.4% |

| S&P/ASX 200 Index (AUD) | -3.4% | -2.8% | -3.6% | 2.8% | 5.6% | 13.2% |

| MSCI ACWI Index (Local Currency) | -4.5% | -2.1% | -0.9% | 7.4% | 8.1% | 15.7% |

| MSCI ACWI Index (NZD) | -5.2% | -2.7% | 9.8% | 13.0% | 14.3% | 16.2% |

| S&P/NZX 90 Day bank bill Total Return | 0.3% | 1.1% | 2.3% | 5.2% | 4.7% | 3.0% |

If you have any questions please contact us on +64 9 308 1450

Information and Disclaimer: This report is for information purposes only. It does not take into account your investment needs or personal circumstances and so is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to your Financial Adviser. This report has been prepared from published information and other sources believed to be reliable, accurate and complete at the time of preparation. While every effort has been made to ensure accuracy neither JMI Wealth, nor any person involved in this publication, accept any liability for any errors or omission, nor accepts liability for loss or damage as a result of any reliance on the information presented.