Monthly View - June 2024

Global share markets rebounded in May

Global share markets rebounded in May, reverting to their upward trend since the beginning of the year after falling in April. Favourable economic data in the US, UK and Europe, a successful US earnings season, and falling longer term interest rates supported the rise in global share markets over the month.

Global share markets rose [1] 3.7% in May and are up 14.9% over the last six months.

Global Equities

Pushing US markets higher was a mixture of US economic data and favourable inflation outcomes that reinforced market expectations the US economy is on track to experience a soft landing this year. A soft landing is a goldilocks scenario of an economy not too hot, nor too cold, where economic growth slows and inflation falls, allowing the central bank to cut interest rates, and the economy avoids recession.

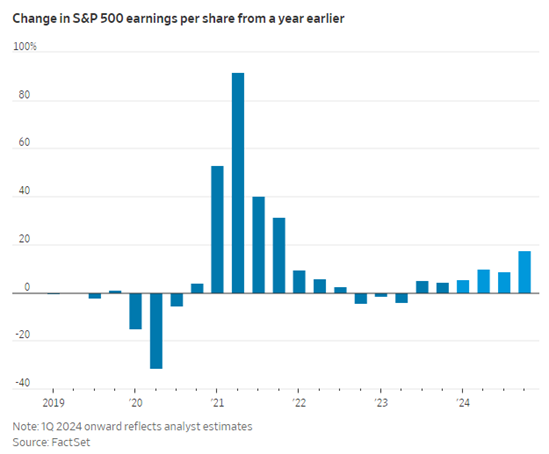

The successful conclusion of the US first quarter’s corporate earnings season also provided support for global share markets. In total, 78% of companies reported earnings results better than expected. The year-on-year growth in US corporate earnings was 5.9%, this is the highest earnings growth over a twelve-month period since early 2022. A feature of the US earnings season, retailers such as Costco, Walmart, Macy’s, and home improvement retailer Lowe’s all delivered profit results ahead of expectation, all benefiting from the ongoing resilience of the US consumer.

Accordingly, the US Dow Jones traded above the 40,000 index level for the first time. Although settling below this level at month’s end, the Dow Jones recorded its strongest monthly gain so far this year, rising 2.6%. The US S&P 500 Index and technology heavy Nasdaq also rose to new all-time highs during the month, returning 5.0% and 7.0% respectively.

Share markets across Europe also reached historical highs during the month on the prospect of a US soft landing, anticipated interest rate reductions in Europe, and better than expected European economic data.

Encouragingly for global equities the outlook for US corporates earnings are expected to have grown by 17.5% over 2024.

The AI hype that has driven global markets over the last few months remains a key feature. Chip manufacturer and datacentre provider Nvidia’s better than expected profit announcement provided a big boost for global share markets. The company’s earnings results are used by investors to gauge the strength of the AI boom that has transfixed markets in recent months. Its strong result suggests demand for the AI chips Nvidia makes remains robust and the AI hype within the markets continues. Nvidia recently became the third-ever company to surpass a market value of US$3 trillion. It joined Apple and Microsoft in that exclusive club. The milestone came only three months after the chipmaker first topped the $2 trillion valuation. Nvidia’s share price has risen 150% since the beginning of the year.

Australasian Equities

Corporate earnings reports dominated the local market in May. Over the month, New Zealand’s share market [2] fell -0.9%, reflecting disappointing earnings updates from several companies. Spark, Fletcher Building, and the Warehouse Group underperformed in May, all providing disappointing profit updates that underline the challenging trading environment and recessionary like conditions in the domestic economy.

On a more positive note, Gentrack, a company which provides billing software for utility companies, performed strongly after providing a positive outlook. The company’s share price has risen by 120% over the last year.

The month finished on a positive note after the owner of the Tiwai Point aluminium smelter, Rio Tinto, and electricity company, Meridian, struck a power supply deal that will extend the life of the smelter by another 20 years. This outcome brings some certainty to the power generation sector in New Zealand. As a result, the share prices of Meridian, Contact Energy, and Mercury all rose strongly on the announcement and contributed to the 2.8% rise in the New Zealand market on the last day of the month.

Australian equities rose 0.9% [3] in May primarily on global developments with domestic factors mixed. Earnings updates from retailers JB Hi-Fi and Super Retail (which owns Rebel Sport and Supercheap Auto, amongst other chains) disappointed and highlighted the tough conditions the Australian economy is currently facing. This was confirmed by the release of the economic growth data over the first quarter of this year. The Australian economy grew by only 0.1% over the quarter. Year on year growth slowed to 1.1%, excluding the COVID period, this is the slowest annual growth rate experienced since the 1991 recession. James Hardie shares fell over the month with the company’s activities in Australia expected to slow and it remains cautious about the outlook for the US housing market. Aristocrat Leisure was amongst the better performing stocks over the month, they delivered a 17% increase in their interim profit to A$723.3 million.

Fixed income and cash markets

Global bond yields fell on favourable inflation outcomes and softer than anticipated US economic data. The US 10-year government bond yield fell 18 basis points (0.18%) to 4.50% over the month. The Bloomberg Global Aggregate Bond Index (New Zealand dollar hedged) returned 0.9% in May.

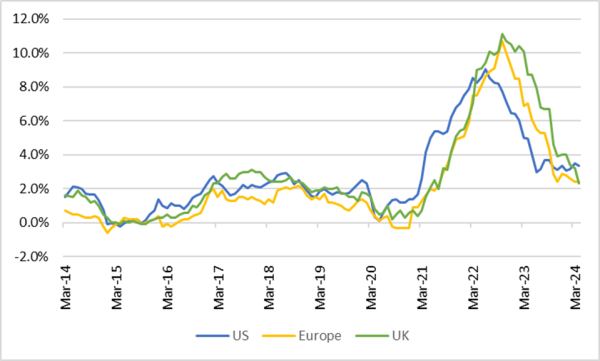

US core inflation, which had surprised to the upside for three consecutive months, was in line with expectations in April. Over the last year core US inflation has risen 3.9%, the lowest annual increase in over three years. Inflation in the UK and across Europe has fallen significantly over the last year.

Global inflation rates (annual)

Source: Bloomberg, JMI Wealth

The dramatic decline in inflation in the UK and across Europe is expected to result in lower interest rates. Recently the European Central Bank cut interest rates, joining the Swiss, Canadian and Swedish central banks who have also undertaken interest rate cuts this year. From a market perspective, this will be the commencement of a global cycle of interest rate reductions that will gain pace over the second half of this year and continue throughout 2025. The US Federal Reserve is forecasted to reduce interest rates later this year on further evidence inflation is falling towards it 2% target.

New Zealand’s longer-term interest rates drifted lower on global events and despite the Reserve Bank of New Zealand (RBNZ) policy statement indicating short-term interest rates will need to be held higher for longer. The local fixed income market [4] rose 0.9% for the month.

The RBNZ, although leaving the official cash rate (OCR) at 5.5% as expected, surprised the market with the tone of its recent Monetary Policy Statement (MPS). The RBNZ placed more emphasis on the sticky domestic inflation pressures rather than the economic recessionary conditions. In the MPS the RBNZ indicated they considered whether to hike the OCR, and their projections implied that the next move was more likely to be a rate hike than a cut. The RBNZ pushed out the first rate cut to late 2025 from the second quarter of 2025 as previously assumed. In contrast, market participants forecast a rate cut for either the last quarter of 2024 or early 2025.

The New Zealand government delivered its budget in May. The budget included promised tax changes which were offset by spending cuts to ensure the policy mix was fiscally neutral. Overall, the budget had a limited impact on local interest rates and the New Zealand dollar, however the risks are to the downside as far as the outlook for the deficit and debt positions and returning the budget to surplus in 2028.

Conclusion

Expectations remain for inflation to continue to trend lower over the year ahead and central banks will lower interest rates as a result. This backdrop is constructive for both fixed income and share markets.

Although the US economy is slowing, a moderate rate of growth is anticipated for 2024. In Europe, economic activity has stabilised recently. This environment is supportive of corporate earnings and as the year progresses companies outside of the large US technology companies will likely make an increasing contribution to global earnings growth. Risks remain around the US recession and ongoing geo-political risks. These remain areas for ongoing monitoring.

Fixed income offers an attractive yield with the potential for capital gains from declines in interest rates. Longer term interest rates are forecasted to decline over the next twelve months, given expectations that inflation will continue to ease and that central banks will commence interest rate reductions. The ongoing weakness in the local economy will place downward pressure on domestic inflation, allowing the RBNZ to commence interest rate cuts. Potentially these could occur earlier than the second half of 2025 as currently anticipated by the Bank.

Focusing on your long-term goals while acknowledging that in the short-term, returns may be volatile, should reward investors.

1 MSCI ACWI Index in local currencies

2 S&P NZX 50 gross index

3 S&P ASX 200 total return Index

4 Bloomberg NZ Bond Composite 0+ Yr Index

Indices for Key Markets

| As at 30 April 2024 | 1 Month | 3 Months | 6 Months | 1 Year | 3 Years p.a. | 5 Years p.a. |

| S&P/NZX 50 Index | -0.7% | 1.3% | 5.1% | 1.3% | -0.4% | 4.0% |

| S&P/ASX 200 Index (AUD) | 0.9% | 1.2% | 10.7% | 12.9% | 6.8% | 7.8% |

| MSCI ACWI Index (Local Currency) | 3.7% | 4.2% | 14.9% | 24.1% | 7.1% | 12.4% |

| MSCI ACWI Index (NZD) | 0.1% | 2.9% | 14.4% | 20.7% | 11.3% | 13.1% |

| S&P/NZX 90 Day bank bill Total Return | 0.5% | 1.4% | 2.8% | 5.8% | 3.4% | 2.4% |

If you have any questions please contact us on +64 9 308 1450

Information and Disclaimer: This report is for information purposes only. It does not take into account your investment needs or personal circumstances and so is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to your Financial Adviser. This report has been prepared from published information and other sources believed to be reliable, accurate and complete at the time of preparation. While every effort has been made to ensure accuracy neither JMI Wealth, nor any person involved in this publication, accept any liability for any errors or omission, nor accepts liability for loss or damage as a result of any reliance on the information presented.