Monthly View - March 2024

Global equities continue to move higher

The strong momentum in global equities from late 2023 has continued into the new year. Global share markets [1] returned 4.3% in February, after gaining 1.2% in January.

During the month several markets reached historical highs, including the US S&P 500 Index and Dow Jones. The Japanese Nikki 225 index finally broke above the December 1989 peak and the European Stoxx600 index moved above its previous high in January 2022. In contrast, the domestic market remains some 14% below its 2021 peak, as measured by the S&P / NZX 50 index. The Australian S&P / ASX 200 index recently reached an all-time high.

Over the month economic data was pushed into the background as investors focused on corporate earnings. Global share markets rose despite higher longer-term interest rates and central banks dampening expectations of an imminent cut in cash rates.

Global Equities

US computer chip manufacturer and datacentre provider Nvidia ignited global share markets following its better-than-expected profit result. The company reported fourth quarter 2023 revenues of $US22 billion, a 265% increase on a year ago. In addition, the company raised its revenue forecasts for the first quarter of 2024 to US$24 billion, which compared to market expectations of US$21 billion. Nvidia’s share price has risen by 250% over the last twelve months, as its chips are considered a key enabler of the artificial intelligence revolution. The company’s market value reached US$2 trillion, making it the third largest listed company in America behind Microsoft and Apple.

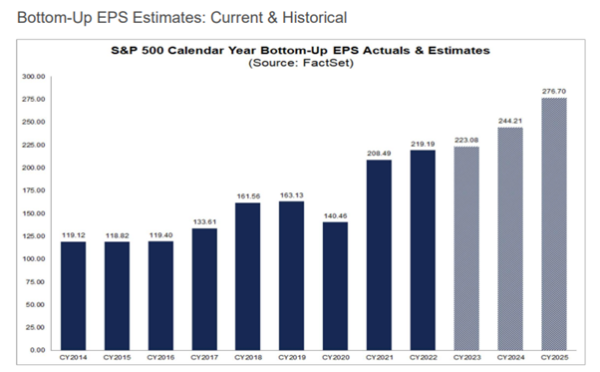

The US earnings season was solid with 73% of companies beating expectations, which is slightly below the historical average outcome. At the aggregate level, earnings grew 4.0% over the quarter which is the second consecutive quarter of year-on-year earnings growth and above the 1.5% growth rate at the start of the reporting season. In calendar year 2024 US earnings are expected to grow by around 9.0%.

US corporate earnings growth

Source: FactSet

Although the Magnificent Seven stocks (Alphabet (parent company of Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia and Tesla) have dominated headlines, earnings outside of this group have also been good. An indication of the growing breadth within the US markets has been several stocks outside of the Magnificent Seven trading at historical highs, including Berkshire Hathaway, J.P. Morgan Chase, and Merck. “Old economy” stocks have also beaten earnings expectations, such as Ford, Disney, Chevron, and Bristol Myers. Three sectors within the S&P 500 index, technology, healthcare, and industrials, are trading at all-time highs.

The strength in the US economy has also boosted global share markets. The US economy grew at a 3.2% annualised rate over the fourth quarter of 2023, much stronger than the 2.0% rate anticipated. As a result, the probability of US recession has faded.

Australasian Equities

The New Zealand share market fell -1.1% on a disappointing corporate earnings season. The general theme from the domestic reporting season was of falling demand and ongoing cost pressures, particularly for those companies tied to the domestic economy (e.g., retail, property, and construction sectors).

The results were mixed. A2 milk showed continued growth in market share and their result surprised to the upside. A2 was one of the top better performing stocks over the month, returning 20.4%. In a month where is was hard to find good news the more stable earnings providers Contact and Meridian outperformed, returning 2.3% and 7.7% respectively.

At the weaker end, Kathmandu (KMD Brands) and Freightways disappointed, reflecting the softness in domestic economic activity. Kathmandu’s share price fell 25.7% over the month while Freightways was flat. Ryman Healthcare also disappointed by reducing its profit guidance on the back of lower unit sales and weaker margins. Its share price fell 18.6% in February and is trading at 11-year lows. Fletcher Building fell 9.3% over the month with a disappointing profit update and a shock announcement of further cost blowouts in two key projects (the New Zealand International Convention Centre is Auckland, requiring substantial remediation work following a fire in 2019, and the Wellington Airport carpark remediation work).

Overall, the profit outlook from domestic companies was cautionary. Although trading conditions remain challenging the worst is likely over, and the economic environment has stabilised. New Zealand companies have welcomed a change in government and are taking comfort that the peak in interest rates has probably occurred.

In Australia the profits season ended on a positive note with more companies beating earnings expectations than those missing. However, the profit outlook has not improved. Consensus expectations are for -5.5% fall in profits this financial year (ending June 2024) with a big fall in energy sector profits on the back of lower oil, coal and gas prices, a small decline in bank profits, and with most other sectors seeing flat to up profits. The bad news has been that revenue growth is slowing and high interest expenses remain a problem. The good news has been that the peak in rising costs may be near and labour market pressures appear to be easing.

At the company level both AMP and Xero bounced 19.0% and 14.9% respectively following better than expected profit announcements. Resource stocks BHP and RIO were amongst the worst performing declining 7.1% and 6.9%.

Fixed income and cash markets

Global bond yields continued to drift higher in February after falling sharply over the final three months of last year. Stronger than expected US economic data and trimming of expectations as to the likely timing and quantum of central bank rate cuts placed upward pressure on global bond yields. The Bloomberg Global Aggregate Bond Index (New Zealand dollar hedged) fell 0.9% in February. New Zealand’s longer-term interest rates also rose over the month on the global backdrop and in the run up to the Reserve Bank of New Zealand (RBNZ) Monetary Policy meeting, where the risk of an interest rate increase was considered a possibility.

Thankfully, the RBNZ left the Official Cash rate at 5.5% and noted that core inflation and inflation expectations have declined. They felt the risks to the inflation outlook had become more balanced with the recent softness in the local economy.

In America, the Federal Reserve (Fed) has expressed concern at cutting rates too soon and allowing inflation to re-ignite. They also acknowledge the risk of holding rates high for too long and causing unnecessary damage to the US economy. The Fed has signalled the possibility of cutting rates this year, likely commencing in June, given the downward trend in inflation.

1 MSCI ACWI Index in local currencies

2 S&P NZX 50 gross index

3 S&P ASX 200 total return Index

Conclusion

The global economic and market environment has not changed over the month. Investment sentiment remains positive, inflation is anticipated to continue to decline over the year, central banks have paused raising rates, and their next move is likely to cut, the US economy remains resilient, and the risk of US recession has faded.

This remains a constructive environment for both fixed income and equity markets.

The outlook for global and domestic fixed income remains attractive. Fixed income offers an attractive yield with the potential for capital gains from further declines in interest rates. Longer term interest rates are forecasted to decline over the next twelve months, given expectations that inflation will continue to ease and that central banks will commence interest rate reductions.

The combination of stability in longer-term interest rate markets and central banks cutting policy rates should be positive for global share markets. Although US economic activity is expected to slow from its robust pace during 2023, the prospects for the US economy have improved in recent months. Against this backdrop, and in the absence of US recession, the outlook for global share markets is positive, with better value seen outside of the US.

Focusing on your long-term goals while acknowledging that in the short-term, returns may be volatile, should reward investors.

Indices for Key Markets

| As at 29 February 2024 | 1 Month | 3 Months | 6 Months | 1 Year | 3 Years p.a. | 5 Years p.a. |

| S&P/NZX 50 Index | -1.1% | 3.8% | 2.2% | -0.4% | -0.5% | 5.5% |

| S&P/ASX 200 Index (AUD) | 0.8% | 9.4% | 7.4% | 10.6% | 9.3% | 8.6% |

| MSCI ACWI Index (Local Currency) | 4.3% | 9.8% | 11.4% | 22.9% | 8.4% | 11.2% |

| MSCI ACWI Index (NZD) | 4.7% | 10.6% | 8.6% | 24.9% | 13.0% | 12.9% |

| S&P/NZX 90 Day bank bill Total Return | 0.4% | 1.4% | 2.8% | 5.6% | 3.0% | 2.2% |

If you have any questions please contact us on +64 9 308 1450

Information and Disclaimer: This report is for information purposes only. It does not take into account your investment needs or personal circumstances and so is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to your Financial Adviser. This report has been prepared from published information and other sources believed to be reliable, accurate and complete at the time of preparation. While every effort has been made to ensure accuracy neither JMI Wealth, nor any person involved in this publication, accept any liability for any errors or omission, nor accepts liability for loss or damage as a result of any reliance on the information presented.