Monthly View - March 2025

US economic policy uncertainty

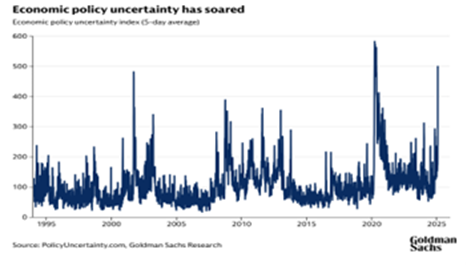

After a strong start to the year, global sharemarkets drifted lower in February, primarily on rising US economic policy uncertainty and the fading of the artificial intelligence (AI) euphoria that drove US sharemarkets higher in 2024.

Newly elected President Trump has wasted no time in advancing his economic policy agenda, issuing a record number of executive orders, and progressing immigration measures and trade policy.

So far Trump has signed close to 75 executive orders. These range from the White House claiming greater control of previously independent agencies, steering the ousting of federal government workers, ending foreign aid across many parts of the globe, and reversing decades of diversity programs, among other conservative priorities. Others have been less serious, including ending the procurement and forced

use of paper straws.

The chaotic pace of the new US administration has led to policy uncertainty. This is highlighted in the graph below. The US Economic Policy Uncertainty Index is based on newspaper coverage, reports from Congressional Budget Office, and a survey of economic forecasters. The measure has jumped to near its highest reading in the last 40 years.

Global Equities

Global sharemarkets [1] fell 0.8% in February, led lower by the US (-1.3%). The European markets outperformed for a second consecutive month. The Euro Stoxx 50 index climbed 3.3% over the month after an 8.1% gain in January. The prospect of peace in the Ukraine and robust corporate earnings is boosting European markets.

The US market struggled in an environment of economic policy uncertainty, particularly in relation to trade policy. February was dominated by rolling threats to impose tariffs, including on Mexico and Canada. By month’s end only an additional 10% tariff on all Chinese imports had been implemented. Albeit, the US is to impose further tariffs, including additional tariffs on China, and new tariffs on Mexico and Canada. In addition, 25% tariffs on all US steel and aluminum imports will be applied on 12th of March.

US large cap technology companies underperformed as the DeepSeek announcement from January continued to weigh on the sector. DeepSeek announced in late January it was able to develop useful AI technology at a much lower cost than had previously been imagined.

Against this backdrop the earnings result from semiconductor manufacturer Nvidia was highly anticipated. The company reported record quarterly revenue of US$39.3 billion, marking a 12% increase from the previous quarter and 78% year-over-year. Despite beating analysts’ estimates, it’s shares fell 8.5% after reporting its profit result on concerns over forecasted first-quarter 2025 profit margins.

Of the other large US technology companies to report in February, Alphabet beat expectations on earnings but disappointed on its cloud revenue. Alphabet also announced capital expenditure plans of US$75 billion in 2025. This was above expectations of $57.9 billion and raised some concerns in the context of the DeepSeek announcement. Amazon also delivered a mixed profit result and their capital expenditure plans of around $100 billion for 2025 unsettled investors.

The US fourth quarter 2024 earnings season wrapped up in February and was positive. Of the S&P 500 companies reporting earnings 75% have exceeded expectations. On a year-on-year basis, earnings have grown 18.2%, which is the highest level since the final quarter of 2021. Encouragingly ten of the eleven industrial sectors reported year-on-year earnings growth. This is a positive development and signifies a broadening of earnings in the US away from an over-reliance on the large cap technology sector.

European corporate earnings results have also been better than forecasted, helping drive European markets to record highs in February. Amongst those reporting positive earnings surprises included Budweiser maker Anheuser-Bush Inbev, Austrian construction supplier Wienerberger, and Danish drug company Novo Nordisk.

Australasian Equities

New Zealand’s sharemarket [2] fell -3.0% in February after several companies delivered disappointing earnings results, and Ryman Healthcare announced a $1 billion capital raise. Amongst those companies delivering disappointing earnings reports, Spark fell -22.0% and Heartland Bank declined -21.3% over the month. Meanwhile a2 Milk rose +37.3% after a better-than-expected profit result. Tower rose 10.5% after a positive update on the outlook for their earnings. Interestingly, Fletcher Building gained 18.5% based on the outlook not being as bad as anticipated. Fisher and Paykel Healthcare (FPH) underperformed in February, down -9.4%. This was primarily due to the likely impact on its earnings from US tariffs on Mexico given FPH has manufacturing capabilities in Mexico that are exported to the US.

The Australian sharemarket [3] declined -3.8% on a mixed profit season and caution over a potential trade war which would impact on the economic activity of some of Australia’s trading partners, while some companies, such as James Hardie, could be directly impacted by US tariffs. Australian banks led the market lower after a disappointing profit update from second tier bank Bendigo and Adelaide, their share price was down 20.0% at one stage. Although the major banks, such as CBA and Westpac delivered solid results, it was National Australia Bank’s (NAB) announcement of loan impairments that unsettled investors. After a period of strong performance, and trading on high valuations, banking stocks fell on this news, NAB fell -12.1% over the month.

Fixed income and cash markets

The Bloomberg Global Aggregate Bond Index (New Zealand dollar hedged) returned 1.2% in February. Global bond returns were driven by the decline in US longer-term interest rates on weaker than forecasted US economic data, as highlighted in the graph below. A reading below zero indicates more economic data surprising to the downside than to the upside.

Citi US Surprise Index

Source: Bloomberg, JMI Wealth

US economic data surprising to the downside included retail sales, consumer confidence, and measures of activity in the services sector. The US PMI Services Sector Index has fallen into contraction territory, reaching its lowest level in two years. In the survey of the services sector, businesses noted increased uncertainty about the business environment, especially from cuts in government spending and tariffs.

The Reserve Bank of New Zealand (RBNZ) cut the Official Cash Rate (OCR) by 50 basis points (0.50%) to 3.75% in February, as was widely forecasted. The RBNZ maintains a bias toward lowering the OCR further. The RBNZ projections show the OCR being near 3.0% by the end of this year.

The Reserve Bank of Australia (RBA) became the latest major central bank to commence interest rate reductions, cutting their cash rate by 25 basis points to 4.10%. The RBA provided a cautionary outlook for further interest rate reductions. They are forecasted to cut rates further.

In contrast, the US Federal Reserve (Fed) has reiterated that they are in a wait and see mode. They appear to be in no hurry to cut interest rates, wanting to see further progress in inflation easing. Although US inflation has fallen, it remains elevated relative to the Fed’s 2.0% target.

New Zealand’s fixed income market [4] returned 0.6% for the month and is up 7.2% over the last twelve months. Local longer-term interest rates drifted lower in February on global events.

Conclusion

The outlook for global equities is mixed because of US economic policy uncertainty. Against this backdrop, and despite recent weak data, the US economy remains resilient. Corporate earnings across America and Europe are also healthy and the Fed has room to reduce interest rates if US growth slows materially. Elsewhere, other central banks will continue to reduce short-term interest rates over the year given the easing of inflation pressures, which will also be supportive of global sharemarkets.

The RBNZ is also expected to cut interest rates further in the months ahead. Lower short-term interest rates and the likelihood that domestic corporate earnings are at cyclical lows provide the opportunity for the local sharemarket to perform solidly in the year ahead.

Both domestic and global bonds offer stability of income and the potential for capital gains from further reductions in interest rates as inflation continues to decline and central banks progress interest rate cuts. The anticipated decline in shorter term domestic interest rates in the months ahead is negative for people looking at term deposits to provide them with income.

At times of market volatility, we recommend investors continue to focus on their long-term goals while acknowledging that in the short-term returns may be volatile. In time, this approach should reward investors.

1 MSCI ACWI Index in local currencies

2 S&P NZX 50 gross index

3 S&P ASX 200 total return Index

4 Bloomberg NZ Bond Composite 0+ Yr Index

Indices for Key Markets

| As at 28 February 2025 | 1 Month | 3 Months | 6 Months | 1 Year | 3 Years p.a. | 5 Years p.a. |

| S&P/NZX 50 Index | -3.0% | -3.4% | 1.6% | 8.1% | 2.6% | 3.0% |

| S&P/ASX 200 Index (AUD) | -3.8% | -2.6% | 2.8% | 9.9% | 9.2% | 8.9% |

| MSCI ACWI Index (Local Currency) | -0.8% | 0.8% | 5.7% | 16.2% | 10.6% | 13.6% |

| MSCI ACWI Index (NZD) | 0.8% | 6.1% | 15.9% | 25.0% | 16.2% | 15.2% |

| S&P/NZX 90 Day bank bill Total Return | 0.3% | 1.1% | 2.4% | 5.4% | 4.6% | 2.9% |

If you have any questions please contact us on +64 9 308 1450

Information and Disclaimer: This report is for information purposes only. It does not take into account your investment needs or personal circumstances and so is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to your Financial Adviser. This report has been prepared from published information and other sources believed to be reliable, accurate and complete at the time of preparation. While every effort has been made to ensure accuracy neither JMI Wealth, nor any person involved in this publication, accept any liability for any errors or omission, nor accepts liability for loss or damage as a result of any reliance on the information presented.