Monthly View - November 2024

Market volatile in run up to US Presidential Election

A dominant market feature of October was a dramatic rise in longer-term US interest rates. Higher interest rates provided a headwind for global sharemarkets over the month. Weakness in global markets over October comes after a period of strong gains from both sharemarkets and fixed income assets, which have resulted in healthy returns over the last year for those investing in a diversified balanced fund.

Please see the Appendix for a discussion on the outcome of the US Presidential election and likely economic and market impacts.

Global Equities

Global sharemarkets fell [1] -1.1% in October and are up 10.3% and 32.0% over the last six and twelve months respectively.

Stronger than forecast US economic data was one of the reasons why US longer-term interest rates rose in October. Although the better-than-expected economic data is positive for corporate earnings, the commencement of the US corporate earnings season provided mixed results and only added to market uncertainty in the lead up to the US Presidential election.

By the end of October 70% of companies in the US S&P 500 index had reported September quarter earnings. Of those companies, 75.5% of them had beaten analysts’ forecasts, which compares to the historical average of 76%. Year-on-year US corporate earnings growth to the end of September is forecasted to be 7.0%, which is down on the 11.6% year-on-year earnings growth recorded in the June quarter.

Mega cap US technology companies, which have led global markets higher over the last year, delivered mixed profit results. For example, although Microsoft and Meta Platforms beat analysts’ earnings forecasts, the firms’ guidance for more AI spending has investors worried over the outcomes of these large investments in the short term. Meanwhile, Alphabet and Amazon beat analyst expectations, and their results were well received by the market. Tesla shares soared 22% immediately after its profit announcement. The market reaction was likely one of relief as Tesla’s share price had fallen over 18% in the lead up to the profit announcement.

Companies outside of the large US technology universe reporting better than anticipated profit results included McDonalds, JP Morgan, Wells Fargo, and Visa. Amongst those companies to disappoint was Caterpillar, as the company reduced its outlook on a slowdown in global construction activity.

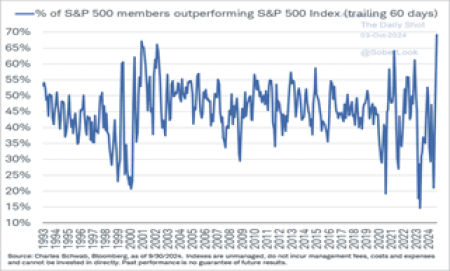

Encouragingly, as the year has progressed more companies are performing well relative to the market, as highlighted in the graph below. At the beginning of the year a narrow set of companies dubbed the Magnificent Seven (Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms and Tesla) drove the US sharemarket higher. More recently, a broader set of companies are outperforming, which has coincided with the US Federal Reserve commencing interest rate reductions and more companies outside the Mag 7 recording year-on-year profit growth.

Percentage of companies outperforming has increased

In New Zealand dollar terms, global equities rose 4.5%, which reflects weakness in the New Zealand dollar boosting returns from offshore assets. The New Zealand dollar weakened nearly 6.0% against the US dollar on better-than-expected economic data in the US, increasing odds that Trump would win the election, and more attractive local interest rates relative to those in NZ.

Australasian Equities

New Zealand’s share market [2] gained 1.7% in October, outperforming the rest of the world. Positive sentiment was maintained domestically on the prospect of further interest rate reductions by the Reserve Bank of New Zealand (RBNZ) and on company specific announcements. Serko (17.9%), Hallenstein Glasson (17.7%), and Ryman Healthcare (15.6%) were amongst the top performing companies over the month.

In October several local companies provided trading updates. Spark downgraded earnings and lowered dividend forecasts. This reflects that the company is seeking to maintain a balance between offering an attractive dividend and invest for future growth without materially raising debt levels. As a result, Spark signalled the prospect of selling non-core assets. Several cyclical companies, those more closely tied to the domestic economy, also provided profit updates. The results were mixed. Freightways provided a trading update that was well received. In contrast, Vulcan Steel provided a downbeat trading update reflecting the ongoing headwinds within the domestic construction industry.

Australian equities fell 1.3% [3] in October, driven mainly by offshore events, including an unwinding of positive market euphoria towards the outlook for the Chinese economy that had boosted Australian resource and mining companies in September. The Australia market also fell following the release of local inflation data, which dashed any hopes of interest rates cuts by the Reserve Bank of Australia (RBA) pre-Christmas. Although Australian inflation is moderating, it remains too high for the RBA to commence interest rate cuts. In a reversal of market performance last month, financial companies outperformed (CBA and National Australia Bank returned 5.4% and 3.8% respectively) and resource companies lagged the market. BHP fell -7.2%, only partially reversing its 16.0% gain in September, and Woodside Energy fell 5.7%.

Fixed income and cash markets

Global bond yields moved higher in October on better-than-expected US economic data and a focus on the growing size of America’s national debt.

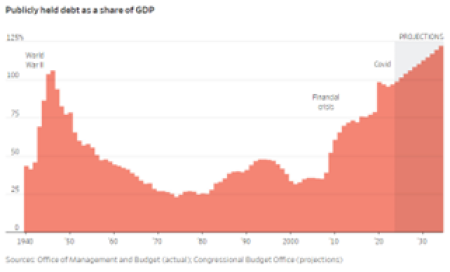

In the lead up to the US Presidential election the size of the US government’s deficit and projected debt levels gained greater market attention. This year’s US budget deficit is on track to top $1.9 trillion, or more than 6% of economic output, a threshold reached only around World War II, the 2008 financial crisis and the Covid-19 pandemic. Publicly held federal debt—the sum of all deficits—just passed $28 trillion or almost 100% of US economic output. The total debt is forecasted to climb by another $22 trillion through to 2034. Interest payments by the US government are poised to exceed annual defense spending.

Source: WSJ

This is a looming issue for America, with neither Presidential candidate offering a credible plan to address the mounting debt levels. The concern for fixed income markets is that a growing deficit will require the US government to issue more bonds. All else being equal, higher interest rates would be required to attract investors to buy these bonds given increased supply.

Over the month the US 10-year government bond yield rose 51 basis points (0.51%) to 4.29%. The Bloomberg Global Aggregate Bond Index (New Zealand dollar hedged) fell -1.5% in October.

New Zealand’s long-term interest rates also drifted higher on global events and despite the RBNZ accelerating the pace of reducing short-term interest rates. In October the RBNZ cut the Official Cash Rate (OCR) by 50 basis points to 4.75%. The RBNZ acknowledged policy settings remain restrictive and that an increase in spare capacity within the economy is leading to lower inflation pressures. New Zealand’s headline inflation for the September quarter fell to 2.2% year-on-year, in line with expectations and taking it back into the RBNZ’s 1.0 – 3.0% target range for the first time since the March quarter of 2021. Additional cuts to the OCR are forecasted over the months ahead.

The local fixed income market [4] fell 0.5% for the month and is up 10.9% over the last twelve months.

Conclusion

The RBNZ is anticipated to continue to cut interest rates aggressively over the months ahead. Further reductions in short-term interest rates and the likelihood that domestic corporate earnings are at cyclical lows provides the opportunity for the local sharemarket to perform solidly in the year ahead.

The relative attractiveness of domestic bonds has declined given the dramatic decline in longer-term interest rates over the last twelve months. The anticipated sharp decline in shorter term domestic interest rates in the months ahead is negative for people looking at term deposits to provide them with income.

Global bonds continue to offer stability of income and the potential for capital gains from further reductions in interest rates as inflation continues to decline and central banks progress interest rate cuts.

Market volatility around the US election outcome is likely (please see the Appendix for a discussion on the likely investment implications of US Presidential election outcome). However, on a longer-term view, and looking through short-term volatility, further reductions in interest rates by central banks and continued US economic growth will be positive for global sharemarkets.

The current environment remains constructive for both fixed income and equity markets. This provides a favourable backdrop for a well-diversified balanced portfolio. In this environment, we recommend investors continue to focus on their long-term goals while acknowledging that in the short-term returns may be volatile. In time, this approach should reward investors.

1 MSCI ACWI Index in local currencies

2 S&P NZX 50 gross index

3 S&P ASX 200 total return Index

4 Bloomberg NZ Bond Composite 0+ Yr Index

Indices for Key Markets

| As at 31 October 2024 | 1 Month | 3 Months | 6 Months | 1 Year | 3 Years p.a. | 5 Years p.a. |

| S&P/NZX 50 Index | 1.7% | 2.2% | 6.1% | 18.4% | -0.4% | 4.0% |

| S&P/ASX 200 Index (AUD) | -1.3% | 2.1% | 8.4% | 24.9% | 8.0% | 8.2% |

| MSCI ACWI Index (Local Currency) | -1.1% | 2.5% | 10.3% | 32.0% | 6.9% | 11.8% |

| MSCI ACWI Index (NZD) | 4.5% | 2.3% | 9.8% | 29.6% | 12.1% | 12.7% |

| S&P/NZX 90 Day bank bill Total Return | 0.4% | 1.4% | 2.8% | 5.8% | 4.2% | 2.7% |

If you have any questions please contact us on +64 9 308 1450

Appendix - US Presidential Election Result

Donald Trump will be the 47th President of the United States, becoming only the second person in American history to be re-elected to non-consecutive terms.

The Republicans have also regained majority control of the Senate with at least 51 seats. The race for the House of Representatives remains tight, and at time of writing vote counting is continuing and the overall composition of Congress (the Senate and House) may not be settled for a few more days or weeks.

Trump campaigned on a platform of extending personal income tax cuts, lower corporate taxes, deregulation, trade tariffs, immigration controls, and re-assessing America’s role in global affairs. If the Republicans secure control of Congress, the President would have greater scope to pursue his policy agenda.

Initial Market reaction

The initial market reactions are likely to set the tone for the months ahead. In general terms, the “Trump trade” has played out. This involves:

• A stronger US dollar. Trump’s policy mix is expected to support a strong US dollar, and the New Zealand dollar fell 1.0% versus the US dollar on the night of the election.

• Higher longer-term interest rates, in anticipation of stronger economic growth and higher US government debt.

• Higher US equities, on the anticipation of stronger domestic economic growth, increased M&A activity and lower personal and corporate taxes. US equity indices reached historical highs on the election result, in part because there was no uncertainty about the result which had been feared given polls had indicated the outcome was too close to call.

• Underperformance of Asian sharemarkets on concern over higher US tariffs on Chinese imports to America.

Thinking longer term – likely economic and market impacts

Geo-politics and trade

From a geo-political perspective American policy toward China is expected to harden. Trump has proposed to place 60% tariffs on imports from China and 10% on imports from the rest of the world. Relations with Europe are also likely to be tested with respect to trade and the war in Ukraine, and a “maximum pressure” approach on Iran risks escalating conflict in the Middle East.

US economic growth

Trump’s policy mix is pro-growth, through lower taxes and higher spending, with tariffs aimed at encouraging more companies to manufacture in the US.

It will take time to enact Trump’s policies, and negotiations, particularly with narrow Congressional majorities, could constrain some policy measures. One example is the scaling back of government spending measures given the current size of US government deficit.

Short-term, a Trump presidency is likely positive for the US economy, reducing the risk of recession in 2025. Conversely, longer-term, tariffs could well be a drag on US growth by reducing demand and lead to lower global growth. A tightening of immigration will result in lower labour force growth which is also a negative for US economic activity. These issues are likely to result in analysts reducing US growth forecasts for 2026.

Lastly, an environment in which longer-term interest rates are higher is also negative for US and global economic growth.

Inflation and US Federal Reserve Policy

Trump’s policy mix is seen as being inflationary. Although we expect the US Federal Reserve to continue to reduce short-term interest rates, the Fed may slow the pace of rate reductions if it perceives the policy mix would lead to higher inflation.

Government debt

There is the risk of even higher US government deficits under a Trump presidency. The size of the US debt level is a looming issue irrespective of who is President and will place upward pressure on US longer-term interest rates. The growing debt levels may be a constraint on Trump, particularly if there are narrow Congressional majorities and US longer-term interest rates move significantly higher.

Investment Implications

As noted above, the initial reaction by markets is likely to dominate in the months ahead. However, given the confluence of factors outlined above, and what is likely to be a period of US policy uncertainty, market volatility can be expected. The sequencing of implementing policy will also have implications for markets. For example, an initial focus on tax cuts and deregulation would provide a boost to the US economy and corporate profits, supportive of equity markets. In contrast an initial focus on tariffs would be viewed as negative for markets.

It is worth noting that there are many factors outside of who is the President of the United States of America that impact on financial markets. For example, the RBNZ and other central banks around the world will continue to cut interest rates given the softening of inflation pressures. This will see domestic short-term interest rates fall further in the months ahead.

Overall, the environment remains broadly constructive for global equities. We will continue to monitor key political, economic, and market developments and inform you if any new investments decisions are made.

We recommend maintaining a balanced position commensurate with an investor’s objective and risk profile.

Information and Disclaimer: This report is for information purposes only. It does not take into account your investment needs or personal circumstances and so is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to your Financial Adviser. This report has been prepared from published information and other sources believed to be reliable, accurate and complete at the time of preparation. While every effort has been made to ensure accuracy neither JMI Wealth, nor any person involved in this publication, accept any liability for any errors or omission, nor accepts liability for loss or damage as a result of any reliance on the information presented.