Monthly View - September 2024

Global markets end August on a high

After a tumultuous month for global financial markets, global equities ended the month in positive territory (+1.7%) and global interest rates moved lower.

Global Equities

S&P 500 index was down nearly 6.0% from the end of July, and close to 10% down from all-time highs in early July. The Japanese sharemarket plunged 12.0% in one day.

It was a convergence of events that led to the decline in global markets. The initial spark was a much weaker than anticipated US labour market report. For July 114k new jobs were created in the US, versus expectations of 175k, a big miss. The US unemployment rate rose to 4.3%, compared to market forecasts of 4.1%. The US labour market report provoked concerns over the outlook for the US economy and potentially the US Federal Reserve (Fed) was being too slow in cutting interest rates to avoid recession.

Almost simultaneously the Bank of Japan (BOJ) not only unexpectedly raised interest rates, but also raised them by a greater amount than anticipated. Unfortunately, the BOJ’s surprise interest rate hike collided with the Fed’s decision to hold interest rates steady in their meeting the day before, as well as the disappointing US labour market data outlined above. This hit the Japanese markets hard as it underlined the divergence in future interest rate settings by the Fed and the BOJ. As a result, the Japanese Yen rose sharply higher, impacting the very popular and crowded Yen carry trade. The carry trade involves investors borrowing at very low interest rates in Japan to buy assets such as shares. The rise in the Yen negatively impacts on the value of these trades for foreign investors, which leads to a sell-off.

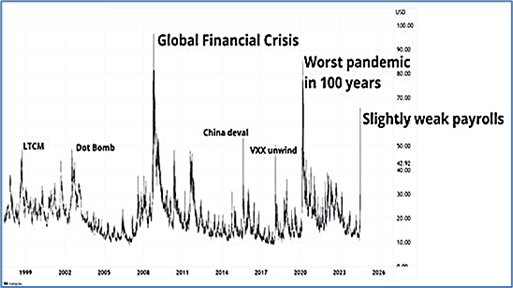

As can be seen in the graph below, the reaction in the US sharemarket to the weaker US employment report appeared overdone when compared to historical market moving events, as measured by the VIX index. The VIX index is a measure of market volatility.

Source: Bloomberg, RBC

A spike in market volatility was overdue after one of the best starts to a year for the US sharemarkets in 2024, and with no decline of greater than 5% since the correction in the second half of 2023.

Market volatility quickly subsided following comforting words from Fed officials that recession concerns were overdone, and comments from the BOJ that they are unlikely to continue to raise rates while markets are volatile. Better than expected US economic data also calmed markets, particularly those showing that US initial jobless claims fell further than forecasted, which allayed concerns over the US labour market.

The US second quarter earnings season is now complete with earnings up 11.6% year-on-year, this is higher than the 7.8% growth anticipated at the start of the reporting season. 79% of companies exceeded earnings expectations.

A key take out from the US earnings season is that corporate earnings are starting to broaden out from the large US technology companies. The non-technology sectors recorded their first year-on-year earnings growth since late 2022. The broadening of earnings growth within the US market is a healthy development.

Earnings results from the large technology companies were mixed and generally disappointed relative to elevated expectations. For example, chip maker Nvidia reported more than $30 billion in sales in the second quarter, which is up 122% from the same period a year ago and ahead of the $28.7 billion analysts had forecasted. Profits from the quarter also more than doubled to $16.6 billion, up from the $15 billion analyst projection. Yet Nvidia’s share price fell over 6.0% on the result, as analyst were disappointed the company had not beaten expectations by more. Nvidia is currently the world’s second largest listed company by market capitalisation and has returned over 140% so far this year.

Global sharemarkets rose [1] 1.7% in August and are up 23.0% over the last twelve months.

In New Zealand dollar terms global equities fell 2.3% over the month because of a stronger New Zealand dollar, which lessens returns from offshore assets. The New Zealand dollar gained 5.0% against the US dollar. This was more about the US dollar weakening in anticipation of the US Federal Reserve commencing interest rate reductions, rather than being New Zealand dollar centric.

Australasian Equities

Corporate earnings announcements dominated the local market in August. The earnings season was mixed and generally disappointed overly hopeful expectations. Those companies with domestic economic exposures disappointed, this included Fletcher Building, Tourism Holdings, Air New Zealand, and Vulcan Steel. Forward looking comments from these companies pointed toward a challenging trading environment persisting for the remainder of this year and into 2025. Effectively, a recovery in domestic earnings has been pushed out.

In contrast Fisher & Paykel Healthcare, Tower, and KMD Brands (Kathmandu) provided stronger than expected trading updates.

Over the month New Zealand’s share market [2] rose 0.4%, although lower interest rates provided support for the domestic market, the mixed corporate earnings results proved a headwind for the market in August.

Australian equities gaining 0.5% [3] in August, after bouncing 4.6% in July. Corporate earnings results also dominated. Although earnings fell 4.3% over the last year, worse than consensus expectations for a 3.5% decline, investors appeared to look through this in hope of lower interest rates later in the year. Earnings bright spots included Healthcare (e.g., CSL delivered earnings at the top of their guidance) and the banks also provided solid results. Over the month CBA overtook BHP as Australia’s largest listed company.

Fixed income and cash markets

Global bond yields drifted lower in August on a softer than expected US labour market report, benign US inflation outcomes, and ongoing expected interest rate reductions by central banks around the world, including the Fed. The Bank of England cut interest rates in August, becoming the latest major central bank to do so, following the European Central Bank, Bank of Canada, and central banks of China, Sweden, and Switzerland.

The Reserve Bank of New Zealand (RBNZ) cut the official cash rate (OCR) by 25 basis points (0.25%) to 5.25% in August. This was the first rate cut since March 2020, and ends 14 months of peak rates, since the last hike in May 2023 to 5.50%. A narrow consensus (14 of 23 forecasters) were expecting the RBNZ to hold rates at 5.50%.

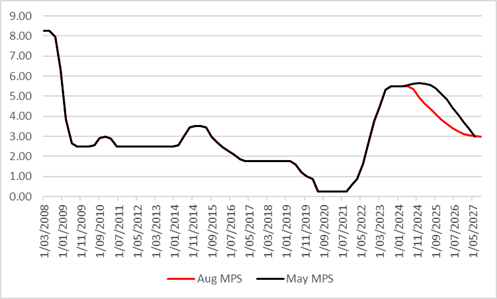

As far as forward guidance goes from the RBNZ’s Monetary Policy Statement (MPS), the RBNZ now anticipate 75 basis points (0.75%) of interest rate reductions in 2024. The RBNZ’s OCR track finishes 2024 at 4.9%, far below the May MPS’s projection of 5.7%. The RBNZ estimate the OCR will end 2025 at 3.8%, 130 basis points (1.3%) below their forecast just three months ago.

RBNZ OCR forecasts May and August 2024 MPS

Source: RBNZ, JMI Wealth

The RBNZ’s interest rate guidance reflects a dramatic change to their economic forecasts. The RBNZ now forecast the New Zealand economy contracting -0.5% and -0.2% over the June and September quarters respectively. Previously they had projected 0.4% economic growth over the six month period, a -1.1% GDP growth U-turn. The RBNZ is now anticipating annual CPI inflation to slump to 2.3% in the third quarter of this year. This is well down on the 3.0% previously forecasted.

The risks to the local economy remain to the downside. The RBNZ forecasts the OCR to be cut toward 3.0%, should the economy be weaker than anticipated by the RBNZ the OCR would need to be reduced further i.e. to 2.0 -2.5%. Arguably, it is difficult to see a sustained improvement in the domestic economy without this occurring, given the current state of economic activity. This means short-term interest rates could potentially move substantially lower than they currently are.

As a result, New Zealand’s short term interest rates fell in August following large declines over July. The local fixed income market [4] rose 0.9% for the month and is up 4.3% over the last three months.

Conclusion

The reduction in interest rates is a positive development for the New Zealand sharemarket. With further RBNZ cuts expected and domestic corporate earnings likely at cyclical lows, there is opportunity for the local sharemarket and property stocks to outperform in the year ahead.

With the RBNZ expected to cut interest rates aggressively over the months ahead, short-term rates, such as term-deposits, are anticipated to fall sharply. Despite recent interest rate declines, fixed income offers stability of income and the potential for capital gains from further reductions. Longer term interest rates are forecasted to decline over the next twelve months, given expectations that inflation will ease further and that central banks will continue to cut interest rates. This will be a positive for fixed income and a negative for people looking at term deposits to provide them with income.

With the US labour market clearly softening the risks of recession have risen. However, at this stage this appears to be a normalising of the US labour market and the economy remains on track for a soft landing. Market volatility, as we have experienced recently, can be expected and comes after a period of strong gains from global shares. On a longer-term view, a reduction in interest rates will be positive for sharemarkets.

The current environment is constructive for both fixed income and equity markets. This provides a favourable backdrop for a well-diversified balanced portfolio. In this environment, we recommend investors continue to focus on their long-term goals while acknowledging that in the short-term returns may be volatile. In time, this approach should reward investors.

1 MSCI ACWI Index in local currencies

2 S&P NZX 50 gross index

3 S&P ASX 200 total return Index

4 Bloomberg NZ Bond Composite 0+ Yr Index

Indices for Key Markets

| As at 31 August 2024 | 1 Month | 3 Months | 6 Months | 1 Year | 3 Years p.a. | 5 Years p.a. |

| S&P/NZX 50 Index | 0.4% | 5.1% | 6.4% | 8.7% | -1.2% | 3.7% |

| S&P/ASX 200 Index (AUD) | 0.5% | 5.7% | 7.0% | 14.9% | 6.7% | 8.1% |

| MSCI ACWI Index (Local Currency) | 1.7% | 5.5% | 9.9% | 23.0% | 7.1% | 12.6% |

| MSCI ACWI Index (NZD) | -2.3% | 4.8% | 7.8% | 17.8% | 10.2% | 12.3% |

| S&P/NZX 90 Day bank bill Total Return | 0.5% | 1.4% | 2.9% | 5.8% | 3.9% | 2.5% |

If you have any questions please contact us on +64 9 308 1450

Information and Disclaimer: This report is for information purposes only. It does not take into account your investment needs or personal circumstances and so is not intended to be viewed as investment or financial advice. Should you require financial advice you should always speak to your Financial Adviser. This report has been prepared from published information and other sources believed to be reliable, accurate and complete at the time of preparation. While every effort has been made to ensure accuracy neither JMI Wealth, nor any person involved in this publication, accept any liability for any errors or omission, nor accepts liability for loss or damage as a result of any reliance on the information presented.